Increased demand for efficiency drives tenants to buildings with more clear height.

Source: Midwest Real Estate News, by Richard Prokup, Sr. VP, First Industrial Realty Trust

Over the last 30 years, the industrial real estate market has seen buildings grow taller to help high-volume tenants in their quest for increased warehouse efficiency. During the 1970s, most buildings were built with clear heights below 20 feet. As modern warehousing practices spread throughout the country, many tenants demanded more and more “cubic” space in their facilities – and buildings grew to 24-, 28- and 32-foot clear.

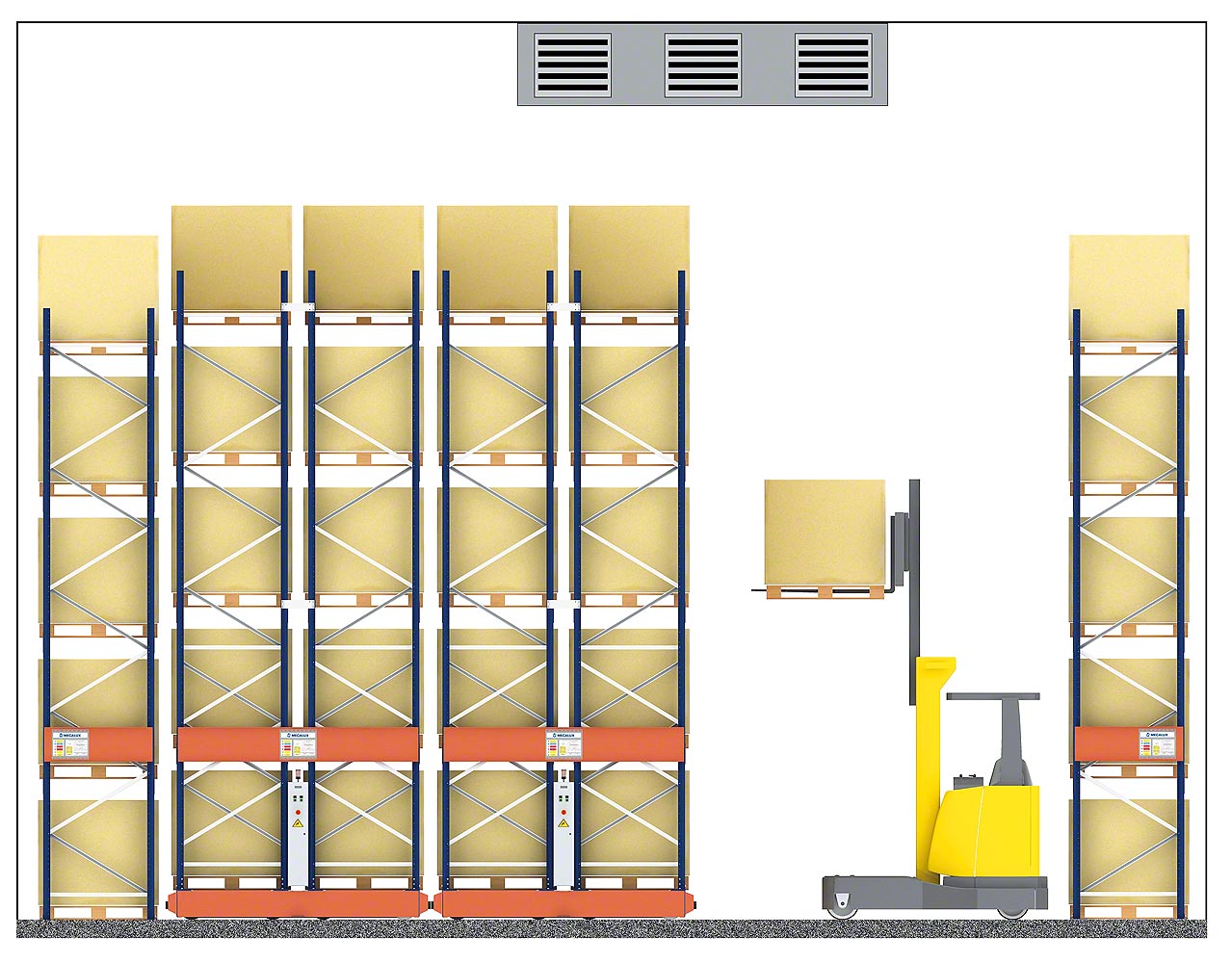

A building’s clear height is defined as the usable height to which a tenant can store its product on racking. This figure is measured below any obstructions such as joists, lights or sprinklers. The latest evolution is a move “upward” to 36-foot clear buildings, particularly in high throughput distribution markets such as Southern California and Indianapolis.

Here we’ll explore the efficiencies of a higher clear height, the costs and the potential tenant demand. The push to higher clear heights is based on the efficiencies of utilizing more cubic space. While the height of a pallet of goods varies, most logistics operators plan for pallet heights of 56, 64 or 72 inches. Since some airspace is required between the product and the next rack, this results in spacing between the racks of 64, 72 and 80 inches, respectively. By far, the most common pallet size is 64 inches, estimated to be used approximately 50 percent of the time. That means 32-foot clear facilities can rack between four and six pallets. In a building with 36-foot clear, a user will usually be able to rack one pallet position higher. Fifty-six inch pallets require 37 feet clear before they can gain another pallet position, but since industrial buildings are built with a sloping roof, even they will get an extra position under the portion of the roof that is elevated to allow for drainage.

Overall, users can increase capacity by 10 to 25 percent by going to 36-foot clear over the same footprint – resulting in a smaller floor area and lower overall rent. The cost of developing a building to the 36-foot height is more than just the cost of additional steel and higher tilt-up panels. A developer must upgrade the sprinkler system and floor thickness. Typically, in a 28- to 32-foot clear building, a developer would use a six-inch floor slab. To accommodate the additional weight of the racking and product associated with the extra clear height, eight inches of slab is recommended for 36 clear or above. A standard ESFR sprinkler system is sufficient for most products in the taller buildings, but the sprinkler heads must be upgraded to allow more water flow.

In addition, the column spacing must be increased in order to accommodate the slightly larger forklift trucks that are required to reach the higher pallet positions. Column spacing of 56 x 50 feet is typical for 36-foot clear. The increase in construction costs for 36-foot clear varies from market to market and building to building, but in rough terms, for a building 300,000 square feet and larger, the higher end of the range is approximately $1.25 per square foot. That breaks out as about 35 cents for structural, 45 cents for the slab and 45 cents for moving to a higher flow ESFR sprinkler head.

The more challenging question to answer is whether demand exists that justifies the additional costs associated with the higher clear, as the vast majority of industrial users do not require it. The answer at this point appears to be market-dependent. In Indianapolis, for example, several institutional investors have been using 36 feet as their standard. More than a dozen such buildings currently exist. The Indianapolis market has seen these assets get absorbed faster and at rents at the higher end of the market, compensating the developers for the additional investment.

In Los Angeles, a number of build-to-suit developments have been completed incorporating 36-foot clear and speculative development has just begun. First industrial recently broke ground on the 555,670 square-foot First 36 Logistics Center @ Moreno Valley in Southern California’s Inland Empire. First Industrial’s decision to use the higher clear was based on demand in the market from prospective tenants specifically looking for that feature. Atlanta and Baltimore have seen a few speculative buildings at 36 clear, with mixed results on leasing success thus far. Demand for higher clear heights comes primarily from consumer products, retail users and especially e-commerce tenants. These types of users carefully research efficiencies in logistics and have grown to appreciate the savings associated with the additional cubic space. This is especially true of areas such as the Inland Empire in California, where average net rents trend well above national averages. Regardless, delivering an acceptable return to a developer on the additional $1.25 per square foot investment is certainly more cost effective to the tenant than increasing the size of its space by 10 to 25 percent.

As an added incentive for the developer, the types of tenants attracted to these buildings tend to be larger, more sophisticated tenants that can offer better financial strength and increased certainty of performance during the lease. Looking ahead, higher clear buildings may make sense in markets where users distribute over a larger geographic area, but, again, most industrial requirements don’t call for the expanded height.

In Houston, where First Industrial is planning to break ground on a speculative development next year, the company is planning a 32-foot clear building since growth in demand is being driven by smaller tenants serving that market.

In Chicago, many tenants are delivering their product nationally or throughout the Midwest and buildings larger than 300,000 square feet are typical in many of the submarkets.

Therefore, given the efficiencies provided by 36-foot clear for a relatively small increase in construction costs, prudent developers will consider the alternative. As the Chicago market continues to tighten and speculative development becomes more prevalent, we will likely see the development of higher clear buildings that will keep the city on the cutting edge of warehousing and logistics.

Richard Prokup is Senior Vice President of Operations for First Industrial Realty Trust’s Central Region, where he oversees asset management and operations for a 35 million-square-foot portfolio. Prokup has more than 25 years of commercial real estate experience.